Story Series: The Broker

FOR ISOs ONLY: HOW TO Make Money Financing ERC Refund Claims in 5 MINUTES OR LESS!

April 24, 2023 You just received a call from one of your favorite merchants saying they had “good news” and “bad news.” When you asked what the “good news” was, they said they had just filed for their ERC refund claim and were getting back $550,000. When you asked what the “bad news” was, they said they wouldn’t be getting the check from the IRS for 6 to 12 months, and needed $120,000 to cover their payroll in 5 days. WHAT WOULD YOU DO?

You just received a call from one of your favorite merchants saying they had “good news” and “bad news.” When you asked what the “good news” was, they said they had just filed for their ERC refund claim and were getting back $550,000. When you asked what the “bad news” was, they said they wouldn’t be getting the check from the IRS for 6 to 12 months, and needed $120,000 to cover their payroll in 5 days. WHAT WOULD YOU DO?

If all you simply said was “no problem- send me a few banks and we’ll take a look at getting you a position,” that would be WRONG! Why? Because you’d be LEAVING $$MONEY ON THE TABLE! Here’s why:

After you have helped Mr. Merchant solve his payroll problem by getting him a position, he’ll keep asking around until he finds “someone else” who can help solve his “other” problem which is HOW TO “monetize” his ERC refund claim and convert it to CASH!

Let’s take a quick look and see how much money you’d be “leaving on the table”- at minimum!

But before we do, let’s look at what you SHOULD HAVE said to Mr. Merchant. Something along the lines of, “thanks for reaching out because we ACTUALLY have a “two-part SOLUTION” for you. The first thing we’re going to do is look at a position to help cover your payroll.

Then, we’re going to bring in our ERC Funding Specialist to identify options for converting your ERC refund claim to CASH, instead of you having to wait 6 to 12 months for the check from the IRS. We only charge a nominal 2% PS fee which we don’t collect until AFTER you’ve been funded. Fair enough?

Plus, we’re ALSO going to arrange an early pay discount on your position in case you elect to use some of the proceeds from the ERC to pay it off early. The savings alone will help reduce your financing costs.

Now let’s take a look and see how much money you’re leaving on the table. First of all, assuming you make 10 points on the position, on $120,000 you’d make $12,000.

Now let’s look at ERC financing. Your PS Fee of 2% on $550,000 would equal $11,000, almost as much as you’d make on the position, and BEFORE adding any referral commission on the ERC side!

Now let’s look at ERC financing. Your PS Fee of 2% on $550,000 would equal $11,000, almost as much as you’d make on the position, and BEFORE adding any referral commission on the ERC side!

In other words, if you simply took “LESS THAN 5 MINUTES” to tell Mr. Merchant you have a 2-Part Solution versus one, you could potentially DOUBLE your money on the deal, right? RIGHT!

But here’s the question: how do you know what ERC funder is the “best fit” for Mr. Merchant? And what questions do you need to ask to make that determination? (Topic of one of my future articles)

The bottom line is, just like with MCAs where one size “doesn’t fit all” – which is why you typically work with more than one funder – ERC funding works the same. Why not apply the same rule?

But here’s the real dilemma: you have a stack of deals on your desk right now and simply don’t have time to identify ERC funders, and even if you did, you don’t have time to become an “instant expert” and know what questions to ask! So now, WHAT DO YOU DO?

One option is to work with a “trusted” ERC Funding Specialist. These are professionals who not only have the ERC funding relationships but know how to pre-qualify Mr. Merchant to determine which ERC funder is the best fit. In addition, they work with all parties “in the weeds” through underwriting, due diligence, final approval, and funding. In a nutshell, while obviously, they can’t guarantee ERC funding no more than you can guarantee MCA approval, the odds of getting the deal across the finish line are typically greater, particularly when there are issues with approval.

And all YOU have to do is two things; (1) TAKE 5 MINUTES OR LESS to tell Mr. Merchant about your two-part solution and can GET PAID when they get funded and (2) ask EVERY OTHER lead, prospect, and client the SAME QUESTION- “By the way, have you already applied for your ERC refund?” and if so, ask “would you like to get your refund now versus 6 to 12 months later?”

And if they haven’t applied yet or have questions about the ERC, tell them you can arrange a 15-minute call to determine their eligibility.

BOTTOM LINE- If you don’t “ask for the order you’ll never get it,” and it only takes “5 MINUTES OR LESS to do so.”

Work With a Broker or Go Direct?

August 2, 2022“I believe that a merchant might be better off going to a broker so the broker can make available to the merchant several different offers,” said Pooja Nene, Broker Relations Manager at Balboa Capital. “And if they’re doing what they need to do correctly and if they’re really consulting the merchant correctly, I think that they would be providing the best offers to the merchant based on their needs.”

It’s the age-old question, are merchants better served by using a broker or going direct? Opinions vary and are usually colored by what role one has in the process.

It’s the age-old question, are merchants better served by using a broker or going direct? Opinions vary and are usually colored by what role one has in the process.

“The advantages of working with a broker is it saves the merchants a lot of time, and in some cases saves them money in fees,” said Randy Guerrier, Senior Funding Executive at Banana Exchange, a company that provides capital to MCA providers. Guerrier’s vantage point makes him less biased. “A lot of brokers do have a lot of preexisting relationships and wholesale rates that they could get with their relationships,” he said.

Matthew Washington, Founder & CEO of Moneywell GRP, says there’s a bit more nuance to the whole thing.

“The reality is that when the merchants go direct with lenders, they’re essentially dealing with the lender’s broker shop, right?” he explained. “Any lender that gets directly contacted by a merchant usually gives them off to their sales team, which [is also able] to send [them] off to other lenders.”

Washington, whose company is a funder, was an advocate for what brokers can accomplish for their clients especially since he relies entirely on them for business. He emphasized that his company is one that doesn’t have a direct sales team to handle any direct inquiries.

“All my business comes from my ISO channel,” he explained. “So when I approve a deal, it’s up to me and the broker to win it if there’s competition, but if I declined the deal, my brokers take that deal to another lender that has an appetite for that particular scenario.”

“[Lenders] may not have the staff available to form that relationship with a merchant,” said Pooja Nene of Balboa about the debate on broker vs. direct. She also cautioned that sidestepping a broker in the process might not translate into an increased likelihood of approval.

“[Lenders] may not have the staff available to form that relationship with a merchant,” said Pooja Nene of Balboa about the debate on broker vs. direct. She also cautioned that sidestepping a broker in the process might not translate into an increased likelihood of approval.

“If it’s the first round of funding, if it’s their first loan schedule, we don’t know who this merchant is, and we may feel a little bit more comfortable with that file coming through the broker and the broker discussing the terms with the merchant,” she said.

Guerrier of Banana Exchange said, “It always comes down to working with the right type of broker, right? It comes down to the person that answers the phone that’s working with you, whether it’s at a big company or small company, I like to look at things from the individual working with the right people.”

And finding the “right people” isn’t automatic because they still have to be found, and once they’re found the lender has to decide if the customer is also right for them. Speaking about that in relation to all the economic uncertainty, Washington of Moneywell GRP said that a funding company should stick to what they’re comfortable with and not “chase deals” that they wouldn’t normally fund.

“But, also [on being found], I would market the heck out of my company and make sure that everyone in the world knows what I do, my product line, my branding, my logo, and make sure that anyone that is looking for capital that they know ‘hey, this company is always popping up,’ and I’d make sure that I stand out,” Washington said.

Lenders Love One-Man Broker Shops, Rookie Broker Finds

January 5, 2022 “After meeting so many people at the Broker Fair in New York City, I was like, ‘you know what, now is the time for it. I’m young, so let’s take the risk and start my own company.’”

“After meeting so many people at the Broker Fair in New York City, I was like, ‘you know what, now is the time for it. I’m young, so let’s take the risk and start my own company.’”

Matt Dolecki, a 23-year old entrepreneur who owned and sold two businesses before he graduated high school, is taking the young hustler’s mindset to the alternative finance world. Just this week, Dolecki started his own brokerage; dubbing it Opulent Capital.

Although Dolecki wants to start funding deals immediately and create relationships across the space, he is aware that he needs to also focus on honing in on the foundations of his business if he wants true success.

“I think a lot of people when they enter this space try to grow too fast and too big too quickly,” he said. “I’m not here to grow extremely fast or extremely big. I’m here to establish a well-rounded company and not tarnish my work just trying to grow fast.”

After interning at a funding company after college and subsequently working for a commercial collections agency, Dolecki believes his experience seeing all sides of the process will set him aside from other brokers.

“I have enough knowledge and information for the merchant to not just broker them the deal, but inform the merchant and let them know exactly what they’re getting, what’s possible for them, and what’s the better option,” Dolecki said.

“I have the debt collection side, and I’ve worked in [small business funding], so I have a really well rounded knowledge of how this whole thing works. If someone were to default, I know exactly which way to go. I can guide the lender on exactly which way to go, I have all the contacts on both sides, lenders and brokers, as well as many debt collections agencies. So I can help lenders not only get business, but retain business and get back lost revenue.”

Not only is Dolecki confident that his experience will set him and his company aside from competitors, he also believes his strength in numbers, or lack of, will allow him to operate a smooth show.

“I’m a one man shop,” said Dolecki. “I’ve talked to a lot of lenders, and they like the idea of having one person to deal with. Information is directly to the source, directly to me and directly to the merchant. It’s an easier form of communication. Every lender I’ve talked to agrees that 90% of their best selling ISOs are one man shops.”

When speaking on creating an image for his company from the merchant’s perspective, Dolecki spoke extensively about different types of marketing. He says that a strategy seemingly based on the business owner’s age can determine what type of communication should be used to pitch that particular merchant.

“If you are trying to reach out to small business owners over the age of 60, most likely a call will be more beneficial rather than investing in marketing or SEO,” said Dolecki. “Now there are so many young business owners who all love technology and doing things online, so building a platform where you can use fintech to apply for loans and search different loan options would be much more beneficial to the younger business owners.”

“I think a good mix of using fintech, algorithms, and tech, but also cold calling and [even] reaching out by mail is an effective way of trying to find that perfect mix of using both types of merchants.”

Dolecki has received support from other brokerages in the industry and claims without help, he would never be in the position he is now.

“Shout out to Porsha and Mercedes Brooks at Brooks Partners Finance,” said Dolecki. “They’ve really been a big mentor for me starting out, and helping me to get the ball rolling. I’m now calling merchants, signing on as an ISO with different lenders, and still just getting started.”

The Broker: A Sister Duo Gets Borrower-Centric

November 29, 2021

When the company she worked at was halted by pandemic woes, Porsha Brooks, then an MCA salesperson, was asked by her sister Mercedes how they could get together and pick up where her other company left off. “My sister approached me at that time saying, ‘well what is it you’re doing, I want some action in that’, then I said, ‘that action is kind’ve drying up— but we can do our own thing, we can start our own business.'”

“So, that’s what we did.”

While offering a suite of loan options to their clients, Porsha spoke with deBanked about how her experience in sales, combined with her small business finance knowledge, has powered the creation of a borrower-centric lending product through their company, Brooks Partners Finance.

“As far as MCAs go, I’m not pro or against it, but at the same time, I know what they are,” said Brooks. “The industry for the most part, every MCA [funder], every broker, is pushing MCAs. Everyone is pushing MCAs. But I see that it really does do a detriment to businesses and business owners.”

Although Brooks Partners still writes MCA deals, that’s only if that is the best option for the client at that time. Brooks claims her company’s business model isn’t to push businesses into whatever type of loan makes sense for her company, but rather the opposite, using different types of tools to figure out exactly what loan is best for the borrower.

“If I have every option for that individual, I don’t have to push them into an MCA,” Brooks continued. “I can still get paid, and still do right by that business owner.”

When speaking about her past work, Brooks spoke about how coming up in an all-male environment was actually a motivating experience.

“They quickly judged, saying ‘you know, she’s a woman, and she’s probably not going to last here for too long, because they normally don’t’ and it turns out I did,” said Brooks. “Three months in, I rose to be one of the top salespeople at the firm. Within that time, I got the attention of both partners at the firm, and I would say about a year in, I was promoted to head their new banking department.”

But when the pandemic slowed the business down, it led to the genesis of Brooks Partners Finance. “I already had certain contacts, I had my foot in the door, and I had a taste for bank loans,” said Brooks.

“I’d say the biggest moneymakers for us are SBA and conventional [loans],” said Brooks. “We have a range of banks that we work with and we are able to give to individuals, not just existing businesses, but startup businesses too. We’ve learned the SBA world like the back of our hand. We’ve been studying this for several months, we basically have to know everything about how to get somebody approved for an SBA.”

With access to these types of loans being notoriously difficult for small businesses to qualify for, Brooks spoke about how teamwork between a broker and a merchant can lead to a plan for approval.

“We’re different [from] most brokers in the industry; we’re very, very hands on here. We stay on from the onset until the funding process. Now what we’re doing is we’re holding our clients’ hand. We’re telling them how they can get qualified, taking them through that process, we’re working with the lender, and not letting the lender cut us out.”

“We make sure that we stay in our lenders’ faces for our clients’ benefit,” Brooks continued. “Making sure we are always a part of that process and making sure things go smoothly, so we do get a lot of SBAs and conventional loans done.”

“I’m not just the ordinary middleman, I am supposed to help [my] client and guide them to their best loan option for their business,” Brooks continued. “If I don’t know where I’m sending them or don’t know if they’re going to be qualified, I am doing them a crazy disservice to my client. That’s where we differ.”

Pandemic-Induced Pivot Results in Innovative Lending Software

October 15, 2021 “What the hell are we going to do now?”

“What the hell are we going to do now?”

Kunal Bhasin, CEO of 1West, saw the light at the end of the tunnel for his business in March of 2020. Instead of closing his doors and pursuing other options in finance, Bhasin held strong and began developing a product that was merely an idea prior to his business’s abrupt halt.

“I made the decision at that point when everyone was running, I hired two full time engineers. I said hey, I’ve had this idea for a long time, the whole company has had this idea for a long time, we just never had the time to implement, and then all we had is time because we [weren’t] closing that many deals.”

The idea, a software called ABLE (Automated Business Lending Engine) is a platform that minimizes the lapsed time that occurs in the funding process. “There were deals all over the place in different people’s inboxes. And then those people would have to put those deals into our processors, which created huge gaps of time,” said Bhasin.

“We needed to centralize the deal flow. Whether the deal is coming from a partner, or the deal is coming from a customer, [we needed] a centralized place where a customer could land and start completing the process.”

With the help of his former college roommate, engineers, and staff, Bhasin put his idea to fruition— and ABLE took off. “We rolled up our sleeves and spent the better part of the last 16 months building it, and now the largest percentage of my time devoted to running 1West is on the software and the platform.”

Bhasin claims that his product gives his company a huge competitive advantage, as he is able to use AI to evaluate, process, and determine the type of funding and through which lender is best on an individual basis.

“[ABLE] really shrinks that entire gap time so when the lenders get in early morning, when the funders get in early morning, our stuff is always in queue, and it’s created really nice returns on the amount of customers we’re getting and the amount of deals we’re funding.”

The automation of the application process has allowed potential borrowers to not only find the ideal package for their needs, but allows them to apply for different types of capital streams, something that would take tons of manpower and time without the ABLE software.

“Greater than 90% of the customers who come into ABLE apply for more than one product,” said Bhasin.

When asked about if there were any plans to license the product in the future, Bhasin was hesitant to give a definite answer for the future of his creation. ABLE is already white labeled by 1West for brokers.

“Maybe,” he said, I want 1West to reap the benefits of it for 6-12 months and fix all the tweaks we have to make. We have a lot going on.”

Broker in Early Twenties Builds MCA Business in Less Than Three Years

February 10, 2021 Davron Karimov, a 22-year-old MCA broker, went from $10k in debt to collecting $200k a year in commissions. It took less than three years, and Karimov shared his journey on his personal, sometimes chaotic, yet always informative YouTube channel.

Davron Karimov, a 22-year-old MCA broker, went from $10k in debt to collecting $200k a year in commissions. It took less than three years, and Karimov shared his journey on his personal, sometimes chaotic, yet always informative YouTube channel.

The Staten Island native said he first started at a Long Island City shop and quickly made some early deals, eventually leaving to start his own firm, FunderHunt, and recently opened an office in Miami.

But do the YouTube videos help him make deals? Of course they do, Karimov says, and he not only gets deals through his video platform but he also get questions from other MCA brokers who reach out for help.

“Of course, we get people all the time calling in, people that have questions, people in the industry need help with their merchants,” Karimov says. “I started around 2018, and there was no info on YouTube about business funding, a huge void online. I stepped up and thought I could be the one to supply info.”

Nearly three years later, Karimov has built an expanding business while helping others through the struggles of being a broker and CEO in the MCA world. In the last year alone, the pandemic caused applications to explode, Karimov says.

“It’s been better than ever; I’ve never seen so many applications in March and April; they were just soaring,” Karimov says. “And then I’ve never seen so many applications get denied because of the industry at the time everything was shutting down.”

It was a time to capitalize if your shop was strong enough to survive what Karimov called the “dark ages” for MCA. If you survived, you get to reap the reward of a capital-deprived market, he says.

“The whole crisis took out so many funders that were just not good, they probably were supposed to go out of business a long time ago, but this accelerated it,” Karimov says. “It took out all the bad funders and replaced them with people that are solid, fast, and have everyone’s best interest at heart, from the merchant to whoever the ISO is.”

According to Karimov, 2020 solidified who is a real player in the game. Launching a new office himself, Davron says he enjoys sunny days in Miami while it is twenty degrees in-between blizzards in New York. Though snow wasn’t the reason he moved, but instead the funding environment.

“Everyone has been warm and welcoming [in Miami], the government knows what this is, and that’s what we do. We try to educate them: not a lot of people know here about this; it’s like it’s a secret,” Karimov says. “If you go to New York, it’s like everybody knows, there are so many shops there. But here, it’s kind of rare to see someone that knows what a cash advance is.”

Compared to New York’s increasingly restrictive funding ecosystem, the Florida space is open to growth. That’s exactly the environment Karimov hopes to profit from, expanding his business in any way that will be geared toward helping businesses.

“I’m not a huge fan of diversification,” Karimov says. “I like doing one thing. But we opened up an office in Miami; we’re bringing experienced people in and trying to fund deals as fast as possible. We’re maybe looking to develop into offering a debit card, whatever is in the business’s best interest.”

Love of Sales Turned Shy Student into LA Real-Estate YouTube Powerhouse

December 18, 2020 “When the Pandemic first started, a lot of the classes we worked with just canceled, everything went downhill,” Loida Velasquez, an LA-based real estate broker, said. “But starting in June until now— everything turned around. Inventory is so low, and there are so many buyers, most houses are selling in 24 hours. I’ve never seen a market like this before.”

“When the Pandemic first started, a lot of the classes we worked with just canceled, everything went downhill,” Loida Velasquez, an LA-based real estate broker, said. “But starting in June until now— everything turned around. Inventory is so low, and there are so many buyers, most houses are selling in 24 hours. I’ve never seen a market like this before.”

It’s a seller’s market like you can’t believe right now, said Velasquez, and that’s what she specializes in: running a cold-calling, door-knocking real estate firm that jumps on expired listings, revamps properties, and sells them on the open market.

After five years of rapid success, Velasquez has taken her charisma to social media, creating a series of Youtube videos to help other brokers find the success she has in the real estate world.

“When I started my real estate career, I remember trying to find videos of people sharing their experience, but most of them were men: I didn’t find many women,” Velasquez said. “So I told myself, ‘you know what, I’m going to start creating videos to put out my journey so people can see what it’s like not only as a real estate agent but as a younger woman in this business.’ And that’s how my channel started.”

Velasquez has also begun teaching online courses for brokers who need help developing their skills. She offers an all-encompassing approach, including cold calling and knocking on doors, that she said many modern brokers don’t use anymore, even though they never became any less viable.

“I knew that the old school approach of cold calling and door knocking was something that a lot of agents don’t like to do,” she said. “So if I became very good at it, I knew that I was going to become successful a little faster than someone who doesn’t incorporate that type of prospecting.”

It has set her apart, and part of why she launched online classes: her videos on real estate were so successful other agencies were telling their trainees to watch her work. Many agencies don’t offer adequate training, Velasquez said, some give out unethical advice. When newly licensed brokers find Velasquez, she said she stands out as an agent with standards and knowledge of the industry.

It has set her apart, and part of why she launched online classes: her videos on real estate were so successful other agencies were telling their trainees to watch her work. Many agencies don’t offer adequate training, Velasquez said, some give out unethical advice. When newly licensed brokers find Velasquez, she said she stands out as an agent with standards and knowledge of the industry.

That knowledge comes in the form of hard-earned experience, one that includes making slip-ups along the way, something she said ocassionally still happens. It’s all part of the game, she explains. Many of her leads come in from her online networking now, but her techniques are still honed to reach out to sellers looking for a knowledgeable agent who knows the market.

“A lot of my business comes from social media, whether it’s from agents that watch me and send me referrals, or just consumers that are trying to learn what it takes to buy or sell a house,” Velasquez said. “But aside from that, I still cold call a lot of ‘for sale by owners’ and expired. Many of them still want to sell, but they had to pull their home off the market. Many of them didn’t have a good relationship with the last agent and want to find someone else who can do a better job.”

And that relationship comes in the form of Velasquez calling out of the blue, flipping the house successfully in a matter of weeks, sometimes two or three sales every month.

Things were not this easy for what outwardly looks like a charismatic, polished agent; Velasquez attests that she was quiet and anxious even to present a school project before she found her love of sales.

“I was the shyest person ever, and I was terrified of talking in group projects,” Velasquez said. “If people from my past saw me, they would never guess I would be doing public speaking events and would have never known this is what I would become.”

Velasquez was a sociology major before getting a side job as a brand ambassador, traveling to conventions and selling face to face to customers. Everything changed.

“Telling people about the product, getting paid to talk to people, helped me get myself out of my shell and comfort zone,” She said. “I don’t know why I was scared of talking to strangers, but it helped me get out there, and I switched my major to marketing.”

After she went back to get an MBA in 2015, she started making Youtube videos and found her passion. She said that with determination, anyone could get over hurdles and find success. Selling real estate is not what it looks like on TV, but Velasquez noted the hard work is worth it for the payoff.

“After the turning point, I started to see people responding ‘because of this video, I got my first listing.’ I said, if I need to get myself out of my comfort zone to help people, this is something I know I need to do,” Velasquez said. “If you stay focused and surround yourself with the right people, you’ll make it. There will be many times you will doubt yourself, and it is not like what you see on TV.”

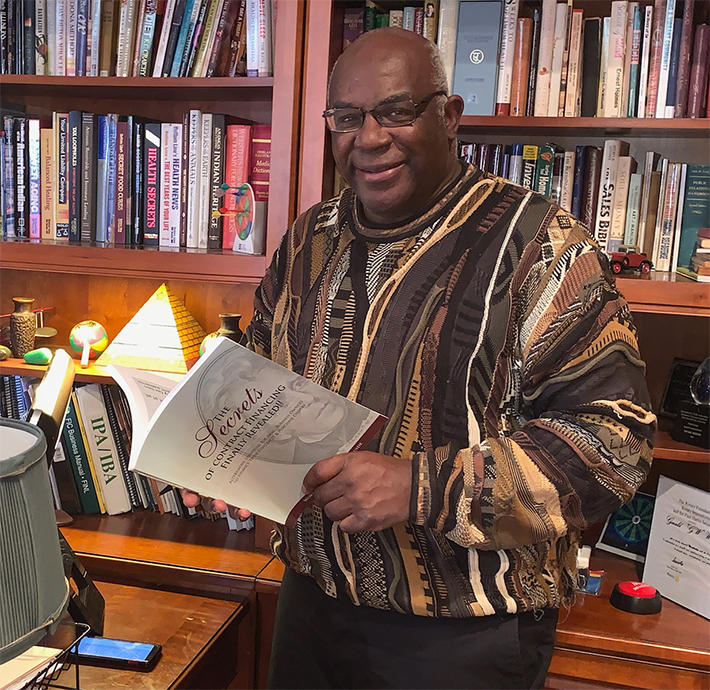

The Broker: How Gerald Watson Mixes Factoring with MCAs

December 3, 2019 Role?

Role?

I’m the owner of The Watson Group, a factoring broker company.

How did you end up in the industry?

I got started in what I call the contract financing industry about 35 years ago, kind of by accident. I had spent years working with a large management consulting company in Boston and we had some major contracts in the DC area. I was on an assignment there and my son was in school there with another kid, and I met the parents and the dad told me what he was doing and he said I needed to come by the offices to check it out.

I really had no intention of going at all, but finally to get this guy off my back, I went by one day and he showed me the business they were in. When I left I was totally on board. I had been working for several years in management consulting, but this was all new and I was excited because it was helping real businesses solve real problems and it was very hands-on.

I came on board and I’ll never forget my first day on the job: I didn’t know anything from anything – rights, factoring, contracts financing – this was years before the MCA industry even existed, and my boss said he just got a job, 911 call from a printer and they needed some funding help. “Can you help them? Why don’t you come ride with me? It’d be good on the job training for you.” And so we sat down with the guy and found a solution for him. And to this day he hasn’t had to close his business.

How were those early days?

Interesting because this was before the internet, almost before cell phones, in fact. I remember at one point when I was being hired, the Motorola flip phone was just coming out and they were like $1,500 around 25 years ago. And I said okay, I’ll take the job but you’ve got to give me one of these Motorola phones, so he did and it was great but this is before the internet and I didn’t really believe in traditional advertising or mailing out brochures, so the strategy I take is called “institutional referral-based marketing.”

In a nutshell, what that is, is working with various institutions that refer clients to use on a regular basis and as part of that process, I’d give talks or seminars and workshops and sit on panels and teach some of these referral groups how to assess deals and package them and get them ready for funding. You know, develop a pretty solid reputation in the industry for what we did and even today we’re 100% referral.

What can you tell me of the style in which you approach deals?

The approach that I’ve always taken is really a diagnostic approach, we kind of almost see ourselves as doctors. If you go to a doctor and you have pain, you may not know what’s causing that pain, you just want to feel better. And so what does the doctor do? They have to understand what’s going on in order to make you feel better.

Client’s got a pain: “I need money. I need working capital and I need it now.” And so we get a clear picture of what their objectives are and what they’re looking to accomplish: how much they need, what they need it for, timing, etc., and like a doctor, we go through a series of diagnostic tests, which can involve getting a list of documents – financials, bank statements, whatever it is – and going through them. You’re drilling down on where they’re at and coming up after that, coming up with what I call a treatment plan or funding strategy.

Here’s the key: you’ve got to ask the right questions, because if you don’t ask the right questions you’ll never get the right answer. All too often what a broker will do is they’ll get right into solutions and answers and talk about why what they offer is the best or why their funder is the best thing since sliced bread without having a picture of what their client’s true needs are in this situation. So I have a whole series of quizzes I’ve done a million times so I don’t need to write them down. I know what they are but I systematically go through ‘em, and we call that a preliminary underwriting interview.

What is the value of combining MCAs and factoring?

Funding solutions typically involve multi-funding products. And that’s where the advent of MCAs came in, and why they’re such a real asset. Because you meet a client today and it’s Wednesday, or Tuesday, hell maybe even Thursday, and the guy’s siting there with half a million dollars in receivables that we can convert into cash but we may need 3 days to do it, but he needs 2 days.

MCAs are a great product because we can step in, solve the problem, get him an immediate injection to stop the bleeding, and take it out from factoring proceeds a few days later. So it’s a great compliment and tool and this is something I’ve tried to educate on both sides. It’s not a threat it’s a complement. The key is how you use it. It’s like two medications. You go to a doctor, they’ll prescribe a list of meds, the key is to make sure they all complement each other.

Any advice for those looking to combine MCAs and factoring?

The first thing you want to do as an ISO who’s interested in developing a factoring brokering business is to understand the basics of factoring: what is factoring, how does it work, how do you qualify, how much does it cost?

The second thing you want to do is look internally to develop your customer base and the quickest customer base is what we call the low-hanging fruit. These are existing merchants that didn’t fund. Any merchant that is in B2B, whether they got funded or not, is a candidate for factoring. So go back through the files, look at the database and you may find out you probably have a lot more than what you ever imagined.

The third is to develop your database of funding resources – of funders.

And the last thing you want to have is a game plan. What’s your game plan and what’s your strategy for moving forward with your factoring broker business?